Australia, NZ and Oceania What changed the week of Feb. 7-13, 2026

AUSTRALIA/NZ/OCEANIA

Mobilized Weekly Risk Brief — Australia, New Zealand & Oceania

What changed this week

Trade controls intensity

- What happened: Critical-minerals policy coordination accelerated among allies, while China signaled tighter oversight via industry briefings on export controls for rare earths/strategic minerals.

- Where: Australia/NZ supply positioning + Asia-Pacific critical-minerals trade routes.

- Why it matters: Contracting, compliance, and pricing for “strategic inputs” can shift quickly—affecting mining investment, downstream manufacturing plans, and defense/clean-energy supply commitments.

- Affected first: Miners, refiners, exporters, port logistics, advanced manufacturing buyers.

- Confidence: Medium (clear direction; exact implementation varies).

- Watch next: New licensing guidance, buyer screening, minimum-price/stockpile moves, and any export-control expansions.

Financial rail fragmentation

- What happened: Australia’s monetary tightening bias and AUD dynamics remained in focus: RBA messaging stressed persistent inflation pressure; large institutional hedging flows signaled active currency positioning.

- Where: Australia (spillover to NZ/Oceania via trade invoicing, tourism, and import prices).

- Why it matters: Higher rates + currency swings transmit into household affordability, business borrowing costs, and import prices (fuel, food, equipment).

- Affected first: Importers, leveraged SMEs, households, infrastructure projects with FX exposure.

- Confidence: Medium–High.

- Watch next: AUD volatility, funding spreads, and any stress in credit-sensitive sectors.

Energy stress

- What happened: Domestic gas security and market rule changes stayed salient as government finalized/advanced gas market review steps; LNG politics/lobbying pressure continued to shape the “supply vs price vs transition” debate.

- Where: Australia (east coast gas market + LNG export dynamics).

- Why it matters: Gas price and availability affect electricity costs, industrial competitiveness, and household bills—especially under heat-driven peak demand.

- Affected first: Energy-intensive industry, utilities, households, critical services during heat events.

- Confidence: Medium.

- Watch next: Domestic supply commitments, price mechanisms, and peak-demand reliability measures.

Supply-chain chokepoints

- What happened: Extreme heat and wildfire conditions increased operational fragility risk (transport disruptions, worker safety shutdowns); meanwhile global maritime routing volatility remains a background driver for island logistics and import lead times.

- Where: Australia (heat/fire exposure); Oceania import routes (high sensitivity to shipping schedule swings).

- Why it matters: Small delays propagate fast in Oceania—inventory buffers are thin, and freight costs pass through quickly to prices.

- Affected first: Retailers, construction inputs, healthcare supplies, food distributors.

- Confidence: Medium (climate disruption signal strong; shipping impacts vary).

- Watch next: Port congestion, insurance advisories, and heat/fire restrictions affecting road/rail and warehousing.

Semiconductor constraints

- What happened: No region-specific “chip shock” headline this week; pressure remains indirect via global trade-control tightening around strategic inputs and tools, and via logistics volatility impacting electronics lead times.

- Where: Australia/NZ electronics import supply chains.

- Why it matters: Network gear, medical devices, industrial automation, and grid components are timing-sensitive to electronics availability.

- Affected first: Telcos, utilities, hospitals, defense contractors, device resellers.

- Confidence: Low–Medium (structural risk; weak week-specific constraint signal).

- Watch next: Any export-control expansion affecting electronics/industrial components; sharp freight spikes.

Compute & cloud sovereignty pressure

- What happened: Australia released a new whole-of-government cloud policy emphasizing secure, modern cloud adoption (effective July 1, 2026), reinforcing “secure-by-default” and modernization pressure.

- Where: Australia (APS), with spillover expectations for government vendors and critical-service operators

- Why it matters: Procurement standards reshape vendor requirements, security baselines, and continuity expectations across the ecosystem.

- Affected first: Government agencies, cloud/MSPs, SaaS vendors, regulated sectors aligning to government standards.

- Confidence: High (policy release).

- Watch next: Implementation guidance, certification requirements, and “approved service” lists.

Cyber / hybrid spillover

- What happened: Reporting and visibility gaps remained a material operational risk: many Australian federal entities reportedly under-report incidents to ASD, reducing shared situational awareness; analysts continued emphasizing persistent state-linked “quiet observation” targeting government and critical infrastructure.

- Where: Australia (federal entities + CI ecosystem)

- Why it matters: Under-reporting delays coordinated defense, increases dwell time, and raises systemic exposure for “upstream dependencies” (identity, networks, shared service providers

- Affected first: Government service operators, critical infrastructure, shared IT providers, citizens relying on digital services.

- Confidence: Medium–High.

- Watch next: New mandatory reporting/enforcement, and incident response capacity signals.

Technology standards divergence

- What happened: Government cloud policy and security baselines continue to harden—useful for resilience, but can increase interoperability friction for vendors operating across jurisdictions.

- Where: Australia public sector + suppliers; NZ/Oceania vendors aligning across multiple regimes.

- Why it matters: Divergent compliance requirements raise costs and slow deployment for cross-border operators and regional programs.

- Affected first: Multi-country MSPs, SaaS vendors, cross-border service integrators.

- Confidence: Medium.

- Watch next: Mutual recognition, shared certification, and standard mapping efforts.

Water / food stress

- What happened: Climate outlook shifted toward a likely La Niña → El Niño transition, with risks of worsening drought/heat in southeast Australia; Reuters also reported a severe heat/fires backdrop early in 2026.

- Where: Australia (drought/heat exposure), wider Pacific rainfall pattern sensitivity.

- Why it matters: Drought/heat elevates food price volatility, insurance losses, grid stress, and water restrictions—compounding cost-of-living pressures.

- Affected first: Households, agriculture, utilities, outdoor labor, remote communities.

- Confidence: Medium (probabilistic climate signal; strong recent extremes).

- Watch next: Reservoir levels, heatwave frequency, bushfire conditions, and crop stress indicators.

Social stability pressure

- What happened: The main stability amplifier is “essentials stress”: persistent inflation pressure (RBA) plus extreme heat/fire conditions increase affordability and service-disruption risk.

- Where: Australia; NZ/Oceania sensitivity through energy/food import costs.

- Why it matters: When bills rise while services become less reliable during climate events, trust and cohesion can degrade locally (especially in vulnerable communities).

- Affected first: Low-income households, remote communities, critical services, SMEs.

- Confidence: Medium.

- Watch next: Utility disconnections, localized protest/strike activity, emergency service strain.

Drivers & causal chain

Driver A — Strategic minerals tightening (controls + alliances)

- Mechanism: Export controls and allied coordination reshape who can buy/sell strategic minerals and under what compliance terms.

- Second-order: Contract repricing, investment delays, compliance overhead.

- Third-order: Manufacturing and defense/clean-energy deployment slowdowns; trade retaliation risk.

- Early-warning metric: New licensing categories, stockpile announcements, sudden export permit slowdowns

Driver B — Inflation persistence and tighter financial conditions

- Mechanism: Central bank tightening bias + valuation/hedging flows influence currency and borrowing conditions.

- Second-order: Higher debt service, reduced discretionary demand, higher import pass-through.

- Third-order: Rising insolvency risk pockets; public service strain.

- Early-warning metric: Wage/inflation prints, credit stress indicators, AUD volatility.

Driver C — Climate extremes hitting infrastructure and labor capacity

- Mechanism: Heat domes/drought/wildfire conditions force operational changes and increase outage and logistics disruption risk.

- Second-order: Insurance costs, supply disruption, health impacts.

- Third-order: Migration pressure from high-risk zones; stability strain.

- Early-warning metric: Fire danger indices, heatwave persistence, insured-loss estimates.

Driver D — Cloud modernization + sovereignty/security baselines hardening

- Mechanism: Government cloud policy raises minimum security and architecture expectations across suppliers and agencies.

- Second-order: Vendor consolidation, higher compliance cost, accelerated legacy retirement.

- Third-order: Better resilience—if implementation capacity exists; otherwise modernization bottlenecks.

- Early-warning metric: New mandated controls, audit cadence, procurement gate changes.

Driver E — Visibility gaps in cyber defense

- Mechanism: Under-reporting reduces shared detection and coordinated response, increasing dwell time and systemic exposure.

- Second-order: Repeated compromises via shared providers/identity.

- Third-order: Trust shocks if government or critical services are disrupted.

- Early-warning metric: Reporting compliance rates, incident volume disclosure, new enforcement actions.

3️⃣ Weekly Risk Index — Pressure Tracking (1–5)

| Indicator | Score | Dir. vs last week | Rationale | Most important supporting signal |

|---|---|---|---|---|

| Trade controls intensity | 3 | ↑ | Strategic minerals controls/alliance moves raising compliance pressure | China rare earth controls briefing |

| Financial rail fragmentation | 3 | → | Tight conditions + currency positioning remain active, not acute | RBA inflation/tight labor signal |

| Energy stress | 3 | → | Gas market/security reform pressure persists; heat elevates peak-demand risk | Gas market review + heat extremes |

| Supply-chain chokepoints | 3 | ↑ | Climate disruption risk + global routing volatility keep lead times fragile | Record heat/fires operational risk |

| Semiconductor constraints | 2 | → | No local shock; indirect exposure via trade/logistics | Strategic minerals controls backdrop |

| Compute & cloud sovereignty | 4 | ↑ | Policy-driven modernization/security baseline tightening | New APS cloud policy |

| Cyber / hybrid spillover | 4 | ↑ | Visibility/reporting gaps + persistent state-linked activity | Under-reporting to ASD |

| Standards divergence | 3 | → | Hardening baselines improve security but can fragment compliance | APS cloud policy |

| Water / food stress | 4 | ↑ | El Niño risk increases drought/heat probability in 2026 | ENSO shift signal |

| Social stability pressure | 3 | ↑ | “Essentials stress” (inflation + climate disruption) is the main amplifier | RBA + heat/fires |

Top 3 rising pressures: Water/food stress; cyber spillover; compute/cloud sovereignty pressure.

Top 2 stabilizing pressures: Semiconductors (no shock); energy (policy active, but no acute supply break this week).

Most likely spillover path: Heat/drought → peak energy demand & higher costs → service disruption + affordability pressure → localized stability incidents.

Regional lens — real-world impacts

United States

- Pricing/supply chains: Critical minerals coordination and China’s controls affect input costs for EVs, defense, and electronics—feeding through to prices and lead times.

Europe

- Trade alignment: Allied critical-minerals positioning and compliance requirements can reshape sourcing and contracting with Australia/NZ suppliers.

Africa

- Food/water/logistics: Oceania climate volatility and global shipping swings can transmit into food price volatility and longer lead times for imports—especially for island and import-dependent markets.

Look Ahead — next 7–14 days watchlist

- Heatwave persistence & fire conditions (AU): triggers operational shutdowns. Trigger: multi-day extreme heat + high fire danger.

- ENSO transition confirmation: escalates drought risk planning. Trigger: updated probabilities + rainfall deficits in SE Australia.

- Government cloud implementation details (AU): clarifies compliance burden. Trigger: guidance, certification, audit cadence.

- Cyber reporting enforcement: improves/doesn’t improve visibility. Trigger: mandatory reporting actions or public posture metric

- Gas market rule/commitment updates: impacts industrial/household price outlook. Trigger: new domestic supply commitments, price mechanism changes.

- Critical-minerals pricing/stockpile moves: shifts market signals quickly. Trigger: new reserve purchases or minimum-price proposals.

- China export-control implementation signals: changes paperwork and timing. Trigger: licensing guidance, compliance inspections.

- AUD volatility and funding conditions: affects import pass-through. Trigger: sharp currency moves or widening credit spreads.

- Insurance / catastrophe loss updates: raises cost base. Trigger: revised insured loss estimates after major fire/heat events.

- Remote/community service strain: early stability signal. Trigger: water restrictions, outages, clinic/supply shortfalls.

Key decision points: RBA guidance; Australia energy/gas regulators; APS digital policy implementers; cyber reporting/enforcement authorities.

Biggest unknowns: How quickly El Niño conditions lock in; whether cyber reporting improves materially; the pace of trade-control tightening on strategic inputs.

Disconfirming signals: Cooling/relief rainfall; lower fire danger trend; measurable improvement in incident reporting/visibility; no new export-control tightening steps.

From Risk to Solutions — Build the bridge

Bridge 1 — Water/Food stress → /solutions/water-food/

- Pressure point: El Niño risk raises probability of hotter, drier conditions and drought stress in 2026.

- Why it matters:

- Higher food price volatility and farm output risk.

- Greater wildfire/health and service-disruption burden.

- Actions

- Business: Heat/drought continuity plans; diversify suppliers; lock in critical inputs earlier.

- Community: Local cooling centers; water conservation programs; community fire readiness networks.

- Policy: Accelerate drought resilience funding, water infrastructure maintenance, and land-use/fire mitigation.

Bridge 2 — Cyber → /solutions/cyber-resilience/

- Pressure point: Cyber situational awareness is weakened by under-reporting, while persistent state-linked activity continues

- Why it matters:

- Longer dwell time = higher blast radius if exploited.

- Shared providers/identity systems can create systemic outages.

- Actions

- Business: Require supplier incident reporting SLAs; identity hardening; tabletop exercises with critical vendors.

- Community: Digital service continuity (offline alternatives for key services); cyber hygiene drives for local orgs.

- Policy: Enforce reporting and minimum controls; fund legacy system remediation; cross-sector incident drills.

Bridge 3 — Compute/cloud sovereignty → /solutions/compute-continuity/

- Pressure point: New government cloud policy drives faster modernization and stronger security baselines.

- Why it matters:

- Procurement rules cascade into private-sector compliance expectations.

- Poorly managed migrations can cause outages or cost blowouts.

- Actions

- Business: Map apps by data sensitivity; adopt multi-region backup; confirm exit/portability plans.

- Community: Encourage resilient local service delivery (libraries/centers as digital access + fallback hubs).

- Policy: Publish clear migration playbooks; require resilience testing; support shared secure platforms for smaller agencies.

Mobilized Weekly Risk Brief — Publish-ready assembly

TL;DR (3 bullets)

- Climate-driven operational risk is rising (heat, fire, drought probability) and will pressure energy, logistics, and affordability.

- Cyber resilience is constrained by visibility gaps as incident reporting remains incomplete across entities.

- Sovereign-by-default cloud modernization is accelerating via new APS cloud policy requirements.

Pressure Map (Top 5)

- Water/food stress (4 ↑)

- Cyber / hybrid spillover (4 ↑)

- Compute & cloud sovereignty (4 ↑)

- Trade controls intensity (3 ↑)

- Supply-chain chokepoints (3 ↑)

What changed this week

- A stronger ENSO transition signal increased the drought/heat risk lens for 2026 planning in Australia.

- Government cloud policy raised the baseline expectations for secure cloud adoption across the APS ecosystem.

- Cyber risk management remains hindered by incident reporting gaps, increasing systemic uncertainty.

Why it matters (Business + Communities)

- Business: Expect higher volatility in operating conditions—worker safety disruptions, peak energy demand, and more stringent cyber/compliance expectations.

- Communities: “Essentials stress” (bills + disruptions) is the fastest pathway to instability—especially during extreme heat and service outages.

Regional Snapshot (USA / Europe / Africa)

- USA/Europe: Critical minerals controls and alliances reshape contracting and compliance, with downstream price impacts.

- Africa: Global supply volatility and climate-linked price effects can amplify food/energy affordability pressure.

Look Ahead (7–14 days)

Watch heat/fire conditions, ENSO confirmation, cloud policy implementation guidance, and cyber reporting/enforcement signals.

Mobilized Action

- Run a heat/drought continuity drill (staff safety, peak-demand power, supply reroutes).

- Stand up “essentials price + outage” local monitoring (water restrictions, blackouts, staple prices).

- Close cyber visibility gaps: require incident reporting SLAs from vendors and internal units.

- Cloud migration readiness check: data classification + resilience tests + rollback plans aligned to new policy.

- Strategic inputs map: critical minerals exposure by supplier/country/route; pre-negotiate alternates.

Accuracy & Trust Layer

- Overall confidence: Medium (strong on climate/cyber/cloud policy signals; weaker on week-specific semiconductors and shipping shocks).

- Top 3 uncertainties

- Speed and severity of El Niño-linked drought/heat impacts.

- True cyber incident rate given reporting gaps.

- How quickly trade controls tighten around strategic minerals and related supply chains.

- What would change our assessment (disconfirming signals): sustained cooling/rainfall relief; measurable improvements in cyber reporting; no further tightening in export-control implementation.

- Source types to verify (categories): meteorological agencies; emergency services/fire authorities; central banks; energy market regulators; port authorities and carriers; national cyber agencies/CERTs; government digital transformation offices.

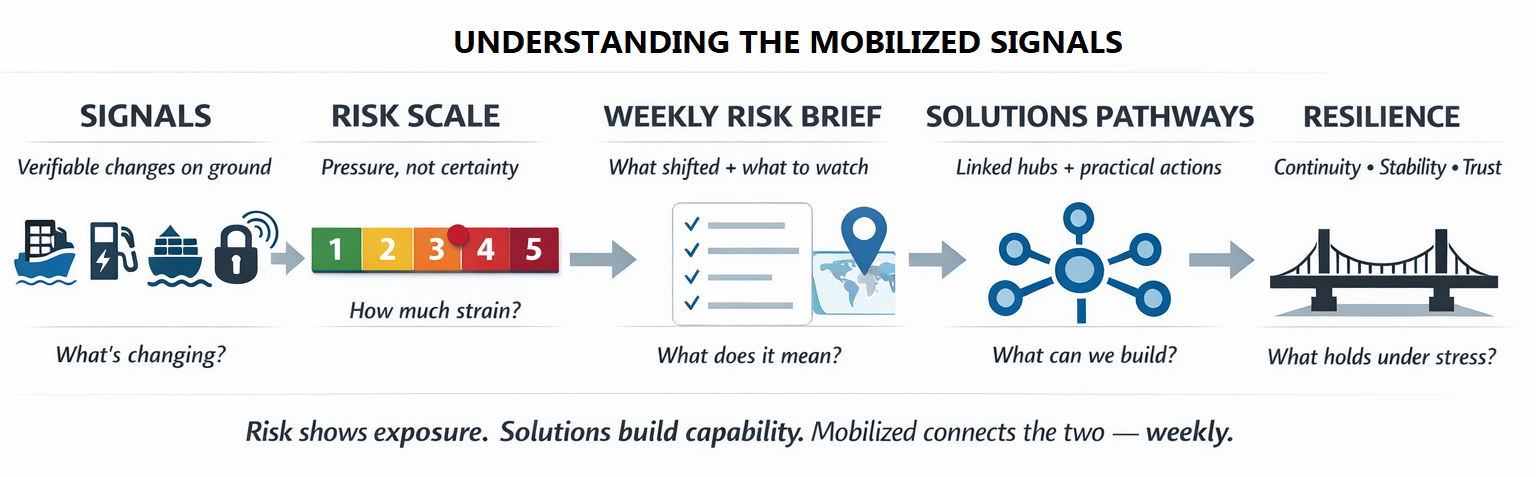

- Weekly rhythm: Monday brief → publish + auto-link solution hubs → Tue–Fri explainers/signals/solutions stories → feed next Monday.