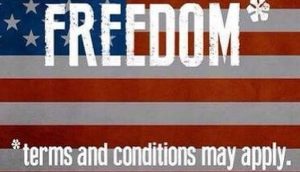

Americans are suffering through a trauma of stolen expectations. The result is what you might call The Great Unhappiness.

First off, are things bad in America right now? Is the economy tanking?

Not at all. America is booming.

- Our economy is growing at 3.2% per year, the highest post-Covid growth rate of any of the G-7 nations.

- Our unemployment rate is the lowest in over half a century.

- Our rate of inflation is lower than the inflation rate in England, Germany or Japan.

- The Dow Jones Industrial average, which was struggling to reach 30,000 in the last year of the Trump presidency, is now close to 40,000, which means more money in the bank account of anyone with a pension fund or a 401(k).

- And paychecks are rising faster than inflation.

So we should be happy, right?

But we’re not. Yes, a whopping 78% of us are “very” or “somewhat satisfied with our lives.” An astonishing number.

But there’s a darker side. In 2022 America was one of the eleven happiest nations in the world. Now, a mere two years later, America has fallen to the 23rd slot, below Costa Rica and Kuwait.

And a February Gallup Poll revealed that Americans are the unhappiest they’ve been in nearly 50 years. Pew Research agrees. 58% told Pew that “life in America is worse today than it was 50 years ago.”

Why all this unhappiness when the economy is soaring? Because of something called the J curve.

The J-curve shows up when your expectations are rising, and suddenly your expectations are blocked.

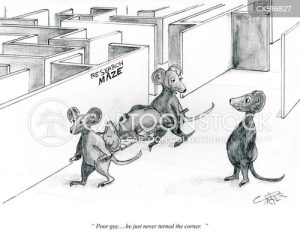

In laboratory experiments, rats were put in a maze that looked like a lane in a bowling alley. Every time the rats ran from the starting point to the maze’s end, they got food. This was done over and over until the rats had a solid expectation of food at the end of their run.

Then the experimenters pulled a nasty trick. They put an electrified grid across the alley just before the feeding point.

So a rat ran down the maze expecting a snack, but just before he hit the dining-spot his feet were sizzled. In other words, the experimenters shattered the rat’s expectations of a treat.

This drove rats into depression. Or a fury.

The J curve works in geopolitics when a people’s quality of life has been improving for a long time, then is suddenly stopped from getting any better or is sometimes even shoved backwards.

For example, the French were on a steady rise in the quality of their lives for decades in the 1700s, then were suddenly stopped by a global food shortage and an international depression. When even the price of a Frenchwoman’s daily bread went up, the result was the French Revolution.

190 years later, in 1979, Iran had been on a long rise in its standard of living. Suddenly that steady rise stopped dead in its tracks. Like the rat, the Iranians went into a fury. They tossed out their ruler, the shah, and pulled off the revolution that brought in the tyranny of the religious scholars, the tyranny of today’s Ayatollahs.

Is anything like that happening in America today? During Covid, people were flush with cash from stimulus checks, child tax credits, and the suspension of student debt payments. But when Covid ended, the subsidies stopped.

And inflation had added more than 25% to the cost of food and rent. That inflation was thanks to Vladimir Putin’s war in Ukraine, a war that cut off a quarter of Europe’s oil supply and sent prices soaring.

In other words, history and Vladimir Putin had turned on the electrified grid at the end of our alley.

One person speaking to PBS’s Paul Solman said that his parents had owned their own home, two cars, and had had a reliable income. But now buying a home is out of reach. And because of the costs of child care, he and his fiancée can’t imagine having kids. His expectations have been blocked.

A woman talking to PBS explained that when the pandemic ended, her student loan payments resumed. She owes $100,000. And that compromises her credit. She has a hard time getting loans for her business. And she has a hard time financing her car.

These are people with blocked expectations, severed expectations, amputated expectations. And they are not happy.

References:

https://news.gallup.com/poll/610133/less-half-americans-satisfied-own-lives.aspx

https://www.gallup.com/analytics/349487/world-happiness-report.aspx