What changed: The Week of Feb. 7-13, 2026

Trade controls intensity

- What happened: Cuba’s fuel squeeze deepened as U.S. pressure on oil supply corridors intensified, forcing operational cutbacks (including aviation fueling limits).

- Where: Caribbean (Cuba) with spillovers across regional aviation, tourism, and adjacent refueling hubs.

- Why it matters: Energy-as-sanctions pressure becomes a trade/logistics constraint (routing, insurance, costs), not just a diplomatic headline.

- Affected first: Airlines, tourism operators, importers, critical services dependent on fuel availability.

- Confidence: High (reported operational restrictions + immediate impacts).

- Watch next: Additional secondary measures, shipping/insurance behavior, and knock-on constraints in neighboring hubs.

Financial rail fragmentation

- What happened: Regional FX and rates sensitivity rose into a data-heavy week; flows strengthened with commodities while investors positioned for inflation/central-bank signals—raising volatility risk in funding and imports.

- Where: LatAm broadly (largest impact where FX pass-through is high and external funding matters).

- Why it matters: “Small” FX moves can quickly reprice food/fuel imports, debt service, and household affordability.

- Affected first: Import-dependent SMEs, households, infrastructure operators with FX-linked inputs.

- Confidence: Medium (macro signal clear; country pathways differ)

- Watch next: Inflation prints, central-bank guidance, and widening in local funding spreads.

Energy stress

- What happened: Acute fuel scarcity in Cuba escalated into system-wide constraints (power cuts, service reductions, transport impacts) and now visibly disrupts international travel operations.

- Where: Caribbean (Cuba) with broader “fragile grid + fuel import” exposure across island systems.

- Why it matters: Fuel shortages translate into “compound outages”: power, mobility, banking/service availability, and public health access.

- Affected first: Households, hospitals, logistics operators, tourism/aviation.

- Confidence: High.

- Watch next: Power rationing duration, humanitarian shipments, and any restoration of oil flows.

Supply-chain chokepoints

- What happened: Caribbean aviation and shipping logistics face new rerouting burdens due to Cuba fuel constraints; meanwhile Southern Hemisphere climate extremes add disruption risk (heat, fires) affecting regional agriculture/transport nodes (notably in South America).

- Where: Caribbean hubs + South America climate-impacted areas

- Why it matters: Island systems have thin buffers—one chokepoint becomes a multi-sector shortage

- Affected first: Airlines/shippers, retailers, healthcare supply chains, food distributors.

- Confidence: Medium.

- Watch next: Freight and fuel price premiums, port/airport operational advisories.

Semiconductor constraints

- What happened: No region-specific semiconductor shock identified this week; constraints remain import/lead-time sensitive via global trade friction and shipping volatility rather than local capacity events.

- Where: Regionwide (electronics, telecom, grid components).

- Why it matters: Even “steady” chip supply can become a service outage risk when logistics/funding tighten.

- Affected first: Telcos, utilities, hospitals, manufacturers importing electronics.

- Confidence: Low–Medium (structural exposure; weak week-specific trigger).

- Watch next: Sudden freight spikes, export-control expansions affecting components/tools.

Compute & cloud sovereignty pressure

- What happened: Not a single headline event dominates, but the regional pattern is rising scrutiny of cloud dependency and digital public services resilience (often triggered after cyber incidents and fiscal/FX pressure).

- Where: Larger economies with expanding digital public services and cross-border data flows.

- Why it matters: Procurement and regulatory baselines can change quickly after incidents—raising compliance and continuity requirements.

- Affected first: Banks, gov tech vendors, MSPs, regulated industries.

- Confidence: Medium (trend-driven).

- Watch next: New public-sector cloud requirements, data localization debates, and continuity testing mandates.

Cyber / hybrid spillover

- What happened: Region continues to treat cyber resilience as systemic risk (notably in finance and public services). Recent central-bank posture in Brazil has emphasized tougher rules in response to cyber pressures—reinforcing “financial rails = cyber rails.”

- Where: LatAm financial systems + government digital services.

- Why it matters: Payment disruptions and fraud spikes quickly degrade trust and stability—especially during inflation stress.

- Affected first: Banks/fintechs, merchants, households, small businesses relying on instant payments.

- Confidence: Medium (pressure signal clear; week-specific incidents vary).

- Watch next: New caps/controls, reporting mandates, and high-severity provider incidents.

Technology standards divergence

- What happened: Capacity-building and regulatory harmonization efforts continue (EU↔LatAm cyber governance workstreams), but implementation varies country-to-country—creating “multi-regime compliance” for regional operators.

- Where: LatAm + Caribbean cross-border providers (payments, telecom, government vendors).

- Why it matters: Divergent standards raise costs, slow deployments, and complicate incident response coordination.

- Affected first: Regional MSPs, telcos, fintechs, critical infrastructure suppliers.

- Confidence: Medium.

- Watch next: Mutual recognition frameworks, baseline security/control catalogs.

Water / food stress

- What happened: ENSO outlook shifted toward an El Niño development window; forecasters flagged potential rainfall decreases for north-central Brazil while Argentina may see more rainfall—raising near-term planning uncertainty for agriculture and hydro.

- Where: South America (Brazil/Argentina impacts highlighted); Caribbean also tracks seasonal rainfall risk through regional outlooks.

- Why it matters: Weather variability hits food prices, hydropower, insurance losses, and health (heat + flooding patterns).

- Affected first: Farmers, food importers, water utilities, low-income households.

- Confidence: Medium (probabilistic, but actionable).

- Watch next: Updated outlooks, reservoir/soil moisture, and early crop stress.

Social stability pressure

- What happened: Energy scarcity and service reduction dynamics in Cuba intensified everyday hardship, while ACLED’s February regional overview flagged elevated criminal violence and emergency measures elsewhere in the region—reinforcing “security + essentials” as the stability axis.

- Where: Caribbean (Cuba) + selected Central America/Mexico security contexts.

- Why it matters: When essential services degrade and violence rises, commerce, workforce mobility, and investment confidence fall.

- Affected first: Households, SMEs, public transport/logistics, tourism.

- Confidence: Medium.

- Watch next: Service disruptions, localized protests, and escalation in criminal violence indicators.

Drivers & causal chain — what’s actually moving the system

Driver A — Energy-as-constraint in island systems

- Mechanism: Fuel access tightens → power generation, transport, and public services degrade in cascade.

- Second-order: Tourism and export earnings weaken; rationing and service backlogs grow.

- Third-order: Stability and health impacts intensify; informal markets expand.

- Early warning metric: Hours of outages/day; fuel allocation notices; airline schedule cuts.

Driver B — FX + inflation sensitivity (“essentials pass-through”)

- Mechanism: FX moves + rate expectations → import costs shift → food/fuel prices move quickly.

- Second-order: Household stress rises; SMEs lose margin; credit risk pockets appear.

- Third-order: Fiscal pressure and political volatility; investment delays.

- Early warning metric: Weekly inflation prints, FX volatility, widening local funding spreads.

Driver C — Climate variability (ENSO transition uncertainty)

- Mechanism: Shifting ENSO probabilities alter rainfall/temperature patterns across key agricultural belts and hydro basins.

- Second-order: Food and power price volatility; insurance losses; logistics disruptions from heat/flooding.

- Third-order: Migration and stability pressure in vulnerable communities.

- Early warning metric: Regional climate outlook updates + reservoir/soil moisture trends.

Driver D — Cyber pressure on financial rails

- Mechanism: Cyber incidents and fraud pressure → regulators tighten controls → payments friction increases.

- Second-order: Slower settlements and higher compliance costs; trust impacts for digital payments.

- Third-order: Informal cash reliance rises; tax base and service capacity weaken.

- Early warning metric: New caps/controls; incident reporting mandates; provider-level disruptions.

Driver E — Security shocks intersecting with economics

- Mechanism: Criminal violence spikes + emergency measures constrain mobility and commerce.

- Second-order: Supply chains reroute, investment pauses, and tourism declines.

- Third-order: Long-run governance and service delivery erosion.

- Early warning metric: ACLED violence indicators; declarations of emergency; transport corridor disruptions.

Weekly Risk Index — Pressure tracking (not prediction)

Scale: 1 (low) → 5 (high)

- Trade controls intensity: 3 ↑ — Energy sanctions dynamics creating real logistics constraints. Signal: Cuba jet-fuel cutoff for airlines.

- Financial rail fragmentation: 3 → — Volatility risk elevated; fragmentation primarily via risk-off and compliance behaviors. Signal: LatAm FX positioning into inflation week

- Energy stress: 4 ↑ — Acute, operational energy constraint in Cuba with broad service impacts. Signal: nationwide shortages/power cuts and aviation fuel limits.

- Supply-chain chokepoints: 3 ↑ — Thin buffers + rerouting + climate disruptions. Signal: aviation refueling re-routes + Southern Hemisphere extremes.

- Semiconductor constraints: 2 → — No specific shock; exposure is indirect. Signal: none week-specific (monitor freight + controls).

- Compute & cloud sovereignty pressure: 3 → — Ongoing procurement scrutiny; no single “trigger” this week. Signal: trend acceleration post-incident cycles (watch policy moves).

- Cyber / hybrid spillover: 4 ↑ — Financial rails treated as systemic cyber risk; tightening posture continues. Signal: Brazil CB tightening/security measures backdrop.

- Technology standards divergence: 3 → — Regional harmonization uneven; cross-border operators face multiple regimes. Signal: EU↔LatAm cyber governance coordination work.

- Water / food stress: 3 ↑ — ENSO uncertainty increases planning risk (Brazil/Argentina impacts highlighted). Signal: La Niña → El Niño probability update.

- Social stability pressure: 3 ↑ — Essentials stress + violence/security pressures. Signal: Cuba service cutbacks + ACLED regional conflict update.

Top 3 rising pressures: Energy stress; Cyber spillover; Water/food stress.

Top 2 stabilizing pressures: Semiconductors (no shock); Financial rails (steady—volatility but not dislocation).

Most likely spillover path: Fuel/energy constraint → logistics/service disruptions → affordability shock → localized stability incidents.

Regional lens — real-world impacts

United States

- Pricing & supply chains: Tourism/aviation rerouting and Caribbean instability can disrupt travel flows and niche supply channels; ENSO shifts affect ag commodity expectations.

Europe

- Energy & trade alignment: EU firms with Caribbean tourism exposure and LatAm ag/commodity dependencies may see volatility; cyber governance cooperation continues but creates multi-regime compliance.

Africa

- Food/water & logistics: ENSO-driven crop shifts and price volatility can transmit through global food markets; Caribbean and South Atlantic routing changes can affect freight costs for select corridors.

Look ahead — next 7–14 days watchlist

- Cuba fuel availability + power rationing trajectory — Trigger: extended outages and deeper transport cuts.

- Airline schedule changes + refueling routings — Trigger: more carriers suspend service or add extra stops.

- Humanitarian shipments vs. sustained fuel supply — Trigger: aid increases but oil flows don’t resume (longer crisis).

- LatAm inflation prints and central-bank tone — Trigger: surprise inflation → abrupt FX moves.

- FX volatility / funding spreads — Trigger: widening spreads for sovereign/financial borrowers.

- ENSO outlook updates (Brazil/Argentina rainfall implications) — Trigger: probability upgrades and early rainfall anomalies.

- Caribbean rainfall / flash-flood outlook signals — Trigger: adverse outlooks in regional climate bulletins.

- Cyber controls in financial systems — Trigger: new caps/requirements or major provider incidents.

- Violence/security escalation in hotspots — Trigger: emergency measures expand or transport corridors are disrupted.

- Tourism revenue stress indicators — Trigger: hotel closures/route reductions intensify in key destinations.

Key decision points: energy/fuel authorities and transport ministries (Caribbean), central banks (rates + liquidity), cyber regulators for finance, emergency management agencies (climate/violence).

Biggest unknowns: whether fuel flows resume; whether ENSO shifts begin showing up in rainfall anomalies; whether cyber incidents cluster around shared providers.

Disconfirming signals: restoration of stable fuel supply; reduced outage hours; FX stability across the week; improving rainfall indicators where deficits are expected.

From Risk to Solutions — Build the bridge

Bridge 1 — Energy stress → /solutions/distributed-energy/

- Pressure point: Acute fuel scarcity is turning into a cascading power + services disruption in the Caribbean.

- Why it matters:

- Reliability failures hit health, transport, and payments simultaneously.

- Tourism revenue and import capacity fall right when costs rise.

- Actions

- Business: Backup power plans (microgrids/solar+storage where feasible), fuel prioritization agreements, “minimum service” continuity playbooks.

- Community: Resilience hubs (cooling, charging, refrigeration), community solar/storage pilots, outage-ready mutual aid networks.

- Policy: Rapid permitting for distributed generation; critical-service microgrid funding; transparent fuel allocation + anti-corruption controls.

Bridge 2 — Cyber → /solutions/cyber-resilience/

- Pressure point: Financial rails face rising cyber pressure and tightening controls—payments continuity is now a resilience issue.

- Why it matters:

- Payment disruptions and fraud spikes degrade trust fast.

- Compliance tightening can slow commerce unless paired with modernization support.

- Actions

- Business: Phishing-resistant MFA for admins, vendor access reviews, offline payment contingencies, incident reporting SLAs.

- Community: Digital safety campaigns for scams, offline fallbacks for essential services, community “cyber hygiene” clinics.

- Policy: Minimum baselines for providers, mandatory incident reporting, funding for legacy remediation and sector-wide drills.

Bridge 3 — Water/food stress → /solutions/water-food/

- Pressure point: ENSO transition probability raises uncertainty for rainfall patterns affecting agriculture and hydropower planning.

- Why it matters:

- Food price volatility hits low-income households first.

- Water variability can trigger power and health stresses (heat/flood impacts)

- Actions

- Business: Diversify sourcing, pre-contract staples, improve cold-chain reliability, water-efficiency upgrades.

- Community: Water conservation drives, local food resilience (gardens/co-ops), heat and flood preparedness.

- Policy: Drought/flood readiness funds, watershed maintenance, early-warning dissemination, targeted food support.

Mobilized Weekly Risk Brief

TL;DR (3 bullets)

- Caribbean energy constraints are now a direct logistics and services risk, with measurable impacts on aviation and daily operations.

- Cyber pressure on financial rails remains a top systemic exposure, driving tighter controls and higher continuity requirements.

- ENSO uncertainty is increasing near-term water/food planning risk across key South American regions.

Pressure Map (Top 5)

- Energy stress (4 ↑)

- Cyber / hybrid spillover (4 ↑)

- Water / food stress (3 ↑)

- Supply-chain chokepoints (3 ↑)

- Social stability pressure (3 ↑)

What changed this week

Fuel scarcity in Cuba crossed into international operations (aviation), while broader regional risk clustered around FX sensitivity, cyber pressure on payments, and ENSO-driven planning uncertainty.

Why it matters (Business + Communities)

- Business: Expect more “compound disruptions” where energy + logistics + payments interact (especially in island markets).

- Communities: Essentials stress rises fastest where outages and price spikes overlap—protecting continuity is a stability strategy.

Regional Snapshot (USA / Europe / Africa)

- USA: Travel/logistics and commodity expectations can shift with Caribbean disruptions and ENSO updates.

- Europe: Compliance and cyber governance cooperation continues; tourism and supplier exposures remain sensitive.

- Africa: Food price volatility can transmit globally as rainfall outlooks shift across producing regions.

Look Ahead (7–14 days)

Focus on fuel/power continuity in the Caribbean, inflation/FX volatility risk, and early ENSO-linked rainfall signals.

Mobilized Action (5 max)

- Stand up “minimum service continuity” plans for energy outages (power, refrigeration, communications, payments).

- Run a payments continuity tabletop (offline fallback + incident reporting + vendor access review).

- Track an essentials basket weekly (fuel, staples, transit availability) to catch early affordability shocks.

- Pre-position critical inventory in island markets (healthcare, water treatment inputs, food logistics).

- Update climate risk triggers using regional outlooks (rainfall, flash flood potential, drought indicators).

Accuracy & Trust Layer

- Overall confidence: Medium (high on Cuba energy/aviation disruption; medium on regionwide macro/cyber and ENSO translation to near-term impacts).

- Top 3 uncertainties

- Duration and severity of Cuba fuel constraints vs. stopgap aid.

- Country-by-country inflation/FX pass-through magnitude over the next two weeks.

- Whether cyber incidents cluster around shared providers (payments/IT).

- What would change our assessment (disconfirming signals):

- Sustained restoration of fuel supply + reduced outage hours;

- FX stability and easing inflation surprises;

- No major payment/provider disruptions plus improved incident reporting.

- Source types to verify (categories): energy ministries/fuel distributors; grid operators and aviation authorities; central banks and statistical agencies; port authorities and carriers; national CERTs/financial regulators; regional climate centers and meteorological services.

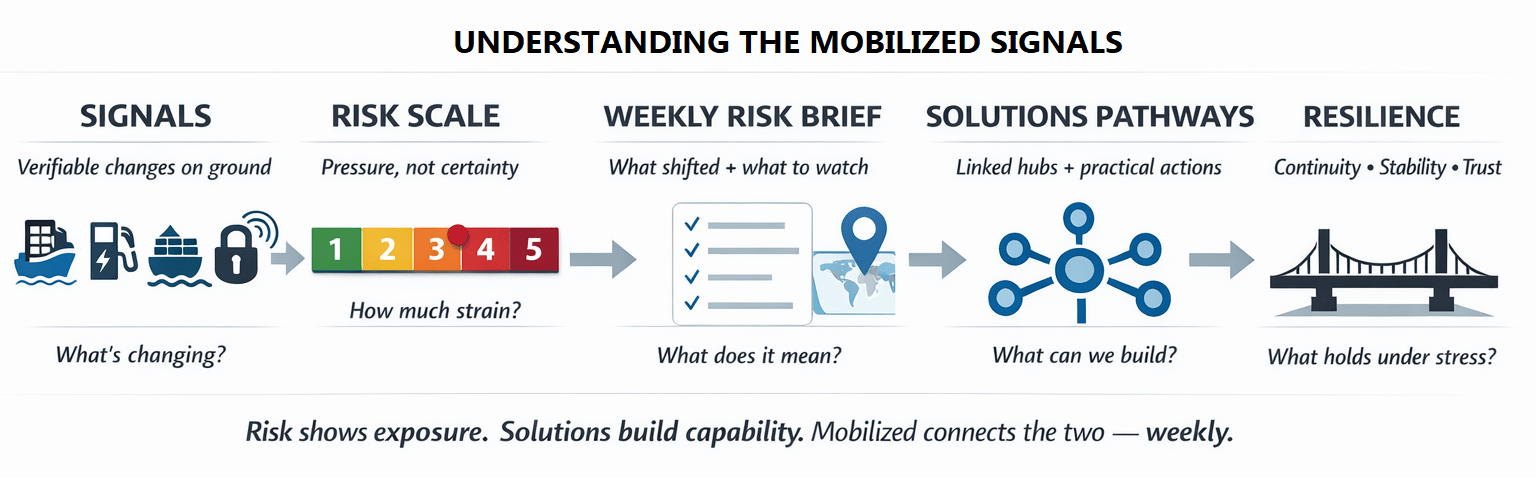

- How this works operationally (weekly rhythm): Monday publish brief + auto-link solution hubs → Tue–Fri spin explainers and local signals → feed back into next Monday.