Europe What changed the week of Feb. 6-13, 2026

EUROPE

Mobilized Weekly Risk Brief

What changed this week

Trade controls intensity

- What happened: EU external trade pressure intensified as tariffs weighed on exports to the U.S. while Chinese import competition increased, tightening the political space for “open trade” assumptions.

- Where: EU-wide trade flows (especially export-heavy economies).

- Why it matters: More trade friction typically means faster shifts in procurement rules, subsidy policy, and “friend-shoring” requirements for suppliers.

- Affected first: Manufacturers, exporters, logistics providers, SMEs tied to cross-border supply chains.

- Confidence: Medium (clear macro signal; policy responses vary by country).

- Watch next: Any new EU trade defense actions, retaliatory measures, or sector-specific restrictions.

Financial rail fragmentation

- What happened: EU Russia sanctions architecture continues to harden around payments and financial messaging (e.g., restrictions tied to Russian domestic payment rails), reinforcing compliance-driven fragmentation.

- Where: EU financial sector + any firm exposed to sanctioned counterparties/flows.

- Why it matters: Compliance friction shows up as delayed settlements, higher due diligence costs, and narrower corridors for cross-border trade finance

- Affected first: Banks, fintechs, exporters/importers operating near sanctioned jurisdictions.

- Confidence: Medium–High (rule direction is stable; operational impact varies).

- Watch next: Enforcement actions, de-risking by correspondent banks, and additional “circumvention” listings.

Energy stress

- What happened: Low snow cover reduced hydropower potential (notably Italy/Austria), raising gas-fired generation and tightening the outlook for already-sensitive gas storage refilling.

- Where: Central/Southern Europe power markets; downstream EU gas balance.

- Why it matters: Hydro shortfalls push gas burn up → storage refills get harder → price spikes become more likely during cold snaps or LNG disruptions.

- Affected first: Utilities, energy-intensive industry, households (bills), and public services under tight budgets.

- Confidence: High (measurable hydro + gas-burn signal).

- Watch next: Late-winter cold spells, LNG delivery hiccups, and storage refill pace.

Supply-chain chokepoints

- What happened: Europe-facing freight remained sensitive to Red Sea/Suez routing shifts; logistics firms flagged the risk of port pressure if routes resume unevenly or re-disrupt.

- Where: Europe import/export gateways; Asia–Europe lanes.

- Why it matters: Transit-time volatility hits inventory, working capital, and delivery reliability—especially for auto, electronics, and healthcare supplies.

- Affected first: Retailers, OEMs, ports/forwarders, manufacturers with thin buffers.

- Confidence: Medium.

- Watch next: Carrier route guidance, insurance advisories, and spot-rate jumps.

Semiconductor constraints

- What happened: Europe reinforced its semiconductor capability push: imec launched a €2.5B “NanoIC” chip pilot line under the EU Chips Act, aimed at next-gen nodes and AI-era prototyping.

- Where: Belgium-led EU ecosystem (with supply-chain and talent spillovers across the bloc)

- Why it matters: This is an “upstream capacity upgrade” signal—helpful for resilience—but it also underscores the urgency created by global chip constraints and strategic competition. (

- Affected first: Advanced manufacturers, ASML/tooling ecosystem, AI hardware programs, research-to-industry pipelines.

- Confidence: High (concrete investment + program launch).

- Watch next: Delivery milestones (e.g., advanced lithography tool deployment) and follow-on funding commitments.

Compute & cloud sovereignty pressure

- What happened: Digital sovereignty debates accelerated: European leaders and firms emphasized “sovereignty-by-use-case” rather than total autonomy, while markets signal rising sovereign cloud demand.

- Where: EU public sector + regulated industries (finance, health, telecom, defense).

- Why it matters: Expect tighter procurement baselines (data residency, operational control, auditability) and more complex multi-cloud architectures.

- Affected first: MSPs/SaaS vendors, critical infrastructure operators, cross-border enterprises.

- Confidence: Medium.

- Watch next: Any EU “tech sovereignty package” details and new public-sector cloud requirements.

Cyber / hybrid spillover

- What happened: The European Commission confirmed a breach of a mobile device management platform (limited personal data exposure, rapid containment), reinforcing the “government-as-target” trend.

- Where: EU institutions; spillover risk via shared service providers and phishing/social engineering.

- Why it matters: Even small data leaks can fuel higher-success phishing against officials and vendors—raising the risk of deeper access later.

- Affected first: Public sector, contractors, critical-infrastructure partners relying on identity and mobile fleets.

- Confidence: High (official confirmation and incident details).

- Watch next: Follow-on advisories, vendor patch cycles, and additional disclosures across agencies.

Technology standards divergence

- What happened: A new global “Trusted Tech Alliance” (including major EU-linked players like Ericsson/Nokia/SAP) launched to promote shared security principles—an explicit response to digital fragmentation pressures.

- Where: Europe’s telecom, cloud, and AI supply chains (and their procurement ecosystems).

- Why it matters: Competing “trust frameworks” are becoming trade instruments: who qualifies as trusted affects market access, procurement, and interoperability.

- Affected first: Telcos, cloud providers, public-sector buyers, cross-border platform operators.

- Confidence: Medium.

- Watch next: Whether governments reference these principles in procurement or regulation.

Water / food stress

- What happened: Europe’s low snowpack is not just energy—it’s a water system signal that can cascade into river flows, hydropower, and agricultural stress later in the season.

- Where: Alpine-fed basins and hydro-dependent regions (Italy/Austria in particular).

- Why it matters: Water scarcity pressure can lift food production costs, insurance losses, and public infrastructure strain (drought response).

- Affected first: Hydro operators, farmers, water utilities, households via price pass-through.

- Confidence: Medium (direction is clear; magnitude depends on late winter/spring).

- Watch next: Spring precipitation, reservoir levels, and early agricultural impact reports.

Social stability pressure

- What happened: Farmers protested in Athens over rising production costs and insufficient support—another “cost-of-living + sector stress” stability signal.

- Where: Greece; similar pressures appear across parts of Europe where food/energy costs remain politically sensitive.

- Why it matters: When essential sectors mobilize, it can disrupt transport corridors, policy calendars, and public trust—especially if paired with inflation anxieties.

- Affected first: Households, food supply chains, local government operations, exporters in affected regions.

- Confidence: High (observable event + persistent driver).

- Watch next: Broader sector strikes/blockades and government concession packages.

Drivers & Causal Chain — what’s actually moving the system

Driver A — Hydro shortfall → gas burn → storage stress

- Mechanism: Low snow → lower hydro output → more gas-fired generation.

- Second-order: Higher gas demand tightens storage refill and supports higher prices.

- Third-order: Household bills rise; industry curtails; political pressure increases.

- Early warning metric: Gas storage refill pace + power-sector gas burn in Italy/Austria.

Driver B — Trade model stress (tariffs + competition) → policy tightening

- Mechanism: Export headwinds and import competition push governments toward protective measures.

- Second-order: Procurement “trusted supplier” rules, subsidies, and screening rise.

- Third-order: Fragmented markets and slower cross-border scaling for firms.

- Early warning metric: New anti-dumping cases, sectoral tariffs, or expanded screening.

Driver C — Suez/Red Sea route uncertainty → lead-time volatility

- Mechanism: Route shifts change capacity and congestion patterns abruptly.

- Second-order: Inventory buffers rise; working capital tightens.

- Third-order: Price volatility in import-heavy categories; production interruptions.

- Early warning metric: Carrier routing bulletins + spot freight indices.

Driver D — Digital sovereignty by procurement → architecture redesign

- Mechanism: “Sovereignty-by-use-case” drives localization, audits, and operational control requirements.

- Second-order: Higher compliance cost, vendor reshuffling, slower deployments.

- Third-order: Increased resilience or migration failures if capacity is insufficient.

- Early warning metric: New EU/Member State sovereign cloud requirements and enforcement actions.

Driver E — Cyber targeting of institutions → trust + continuity risk

- Mechanism: Even “limited” breaches generate phishing leverage and supply-chain compromise pathways.

- Second-order: Incident response burdens, procurement freezes, and vendor audits.

- Third-order: Service disruption or trust shocks if exploitation escalates.

- Early warning metric: Follow-on disclosures across agencies + high-severity vulnerability advisories.

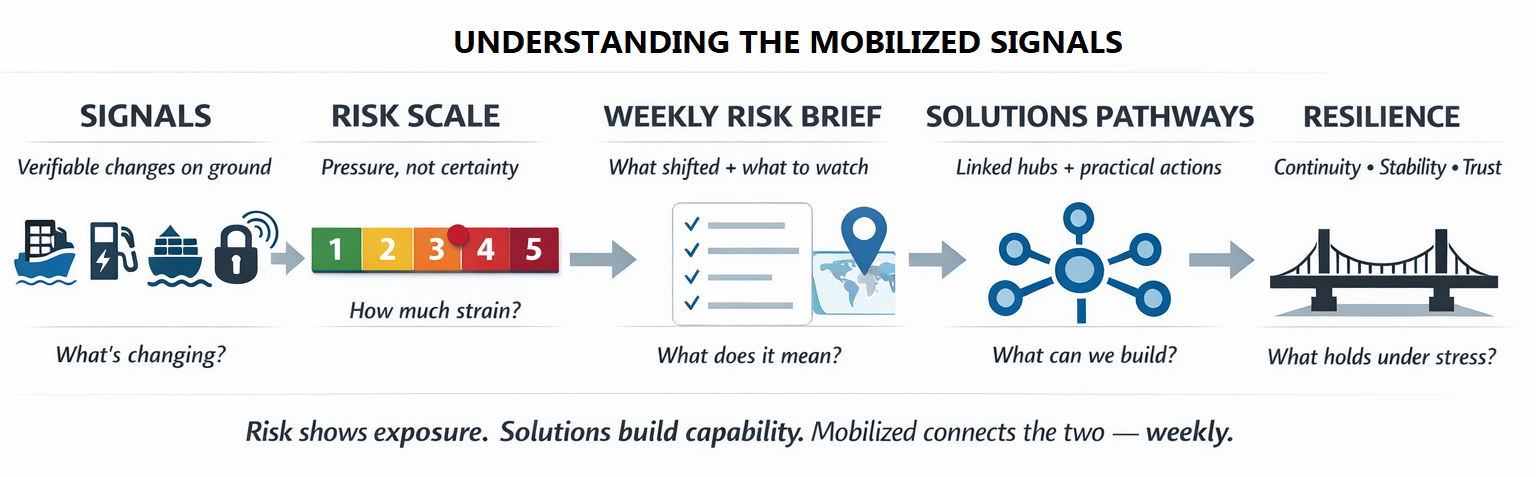

3️⃣ Weekly Risk Index — Pressure Tracking (1–5)

| Indicator | Score | Dir. | Rationale | Single strongest signal |

|---|---|---|---|---|

| Trade controls intensity | 3 | ↑ | Trade friction rising; pressure toward protective moves | EU trade surplus strain/tariff impact |

| Financial rail fragmentation | 3 | → | Sanctions-linked payment constraints persist | EU sanctions/payment-rail restrictions |

| Energy stress | 4 | ↑ | Hydro shortfall pushes gas burn and price risk | Low snow → higher gas burn |

| Supply-chain chokepoints | 3 | ↑ | Routing uncertainty keeps lead times unstable | Red Sea/Suez route sensitivity |

| Semiconductor constraints | 3 | → | Capacity building underway; constraint risk remains structural | imec €2.5B NanoIC pilot |

| Compute/cloud sovereignty pressure | 4 | ↑ | Sovereignty push accelerating via procurement logic | EU sovereignty debate + sovereign cloud growth |

| Cyber / hybrid spillover | 4 | ↑ | EU institutions confirmed breach exposure | EC mobile mgmt breach |

| Standards divergence | 3 | → | “Trusted tech” frameworks proliferate | Trusted Tech Alliance launch |

| Water / food stress | 3 | ↑ | Snowpack shortfall flags spring water risk | Low snow/hydro shortfall |

| Social stability pressure | 3 | ↑ | Cost-of-production protests signal essentials stress | Greek farmer protests |

Top 3 rising pressures: Energy stress; cyber spillover; compute/cloud sovereignty pressure.

Top 2 stabilizing pressures: Financial rails (steady, compliance-driven); semiconductors (capacity-building signal offsets near-term anxiety).

Most likely spillover path: Low hydro → higher gas burn → higher power costs → household/industrial pressure → greater protest and policy volatility.

Regional lens — what it means where you are

United States

- Pricing/supply chains: Europe’s energy volatility and shipping uncertainty can transmit into transatlantic pricing for industrial goods and components, while tariffs reshape EU–US trade flows.

Europe

- Energy: Hydro shortfalls increase gas reliance and raise late-winter volatility risk.

- Trade/regulation: Trade model pressure supports more screening, targeted subsidies, and “trusted supplier” procurement.

- Social stability: Essentials stress shows up as sector mobilization (farmers), which can disrupt logistics and politics.

Africa

- Logistics + costs: Europe’s shipping and energy volatility affects freight rates and the cost of EU-linked imports (machinery, medicines, food inputs) into African markets.

Look ahead — next 7–14 days watchlist

- Gas storage refill pace (and any cold snap). Trigger: sustained drawdowns or price spikes.

- Hydro output updates in Italy/Austria. Trigger: continued deficits into late Feb.

- Carrier route guidance (Red Sea/Suez). Trigger: abrupt reversals or insurance warnings.

- EU trade defense actions (anti-dumping, safeguards). Trigger: new filings or announcements.

- Further EU-institution cyber disclosures. Trigger: follow-on advisories, supplier compromise indicators.

- Sovereign cloud procurement moves. Trigger: new “approved cloud” or operational control requirements.

- Food price expectations/stress signals. Trigger: sharp weekly grocery inflation prints or subsidy/policy moves

- .Protest escalation / transport disruption (farm sector). Trigger: blockades, multi-country coordination.

- Semiconductor program milestones. Trigger: new EU Chips Act commitments or tool delivery milestones.

- Sanctions enforcement signals (payments/trade circumvention). Trigger: new listings or penalties.

Key decision points: energy regulators/utilities; EU trade authorities; cyber agencies/EU institutions; public-sector procurement bodies for cloud.

Biggest unknowns: late-winter weather; Red Sea route stability; whether cyber incidents broaden from “limited breach” to supplier compromise.

Disconfirming signals: improved snowfall/precipitation; stable freight indices for two weeks; no further public-sector breach cascade.

From Risk to Solutions — Build the bridge

Bridge 1 — Energy stress

- Pressure point: Hydro shortfalls are raising gas burn and price volatility risk.

- Why it matters:

- Utilities face tighter margins and consumers face higher bills.

- Gas storage refill becomes harder, raising late-winter vulnerability.

- Actions

- Business: Peak-load plans; secure flexible demand response; diversify hedges and fuel options.

- Community: Local resilience hubs (backup power, warming/cooling centers); energy efficiency “rapid retrofits.”

- Policy: Fast-track distributed generation + grid upgrades; support demand flexibility markets.

Bridge 2 — Cyber / hybrid spillover → /solutions/cyber-resilience/

- Pressure point: Confirmed EU-institution breach reinforces the “public sector is a target” reality.

- Why it matters:

- Small data leaks can power high-success phishing and vendor compromise.

- Government continuity impacts public trust and essential services.

- Actions

- Business: Harden identity; vendor access reviews; phishing-resistant MFA for executives and admins.

- Community: Improve “offline fallbacks” for essential services (forms, payments, appointments).

- Policy: Minimum security baselines for shared providers; rapid disclosure + coordinated patch programs.