What changed the week of Feb. 7-13, 2026

Mobilized Weekly Risk Brief (Asia)

What changed this week

Trade controls intensity

- What happened: U.S. lawmakers pressed for tighter export controls on China’s access to advanced chipmaking tools (including services/maintenance), reinforcing the “controls + compliance” direction.

- Where: U.S.–China tech trade (Asia-wide downstream impact).

- Why it matters: Even talk of broader controls drives stockpiling, vendor screening, and longer procurement cycles across Asian electronics and industrial supply chains.

- Who is affected first: Semiconductor fabs, equipment vendors, electronics manufacturers, cloud/AI infrastructure buyers.

- Confidence: High (clear policy signal).

- Watch next: Whether controls expand to “countrywide” restrictions and allied coordination (EU/Japan/Netherlands toolchain).

Financial rail fragmentation

- What happened: The Indian rupee stayed under depreciation pressure with markets citing persistent USD demand and the likelihood of RBI support/intervention to curb sharper moves.

- Where: India (spillover via trade invoicing, import costs, and regional risk sentiment).

- Why it matters: Currency pressure = higher cost of imported energy/inputs + tighter working capital, especially for SMEs and import-reliant sectors.

- Who is affected first: Importers (fuel/chemicals/electronics), leveraged firms, households via inflation pass-through.

- Confidence: Medium–High.

- Watch next: NDF/spot dislocations, FX reserve changes, and any explicit tightening of cross-border payment compliance.

Energy stress

- What happened: China’s LNG imports were expected to recover in 2026 (after a 2025 drop) but not necessarily back to 2024 levels—pointing to a “demand returns, but price sensitivity remains” dynamic.

- Where: China + broader Asia LNG market (procurement and price-setting).

- Why it matters: Gas/LNG pricing and availability shape industrial output, power reliability, and household affordability across Asia—especially during weather volatility.

- Who is affected first: Power generators, heavy industry, city utilities, vulnerable households.

- Confidence: Medium.

- Watch next: LNG spot price moves, procurement tenders, and weather-driven demand spikes.

Supply-chain chokepoints

- What happened: Red Sea/Suez uncertainty continued to distort capacity and planning; large carriers still framed 2026 as sensitive to route normalization vs renewed disruption.

- Where: Asia–Europe lanes and transshipment hubs (South Asia/SEA port networks).

- Why it matters: Transit-time volatility hits inventory, cash conversion cycles, and delivery reliability—especially for electronics, auto parts, and apparel.

- Who is affected first: Exporters, retailers, OEMs, ports/forwarders.

- Confidence: Medium.

- Watch next: Carrier routing announcements + insurance advisories (fastest leading indicators)

Semiconductor constraints

- What happened: Control pressure increased around the tools that enable leading-edge chips (and keeping existing tools running), raising constraint risk even without a “chip shortage headline.”

- Where: East Asia manufacturing ecosystem (China/Taiwan/Korea/Japan toolchain).

- Why it matters: Capex delays or service restrictions can ripple into device availability, industrial automation, and AI infrastructure rollout timing.

- Who is affected first: Foundries, equipment maintenance/service vendors, downstream electronics assemblers.

- Confidence: Medium–High.

- Watch next: New restrictions on subcomponents + service/maintenance support.

Compute & cloud sovereignty pressure

- What happened: Sovereign cloud demand continued to surge globally (large growth forecast for 2026), reinforcing Asia’s push toward local hosting + data residency architectures.

- Where: Asia-wide, with pressure strongest where localization rules are strict (e.g., China/Vietnam/Indonesia; “potentially India”).

- Why it matters: Firms face higher compliance costs, architectural redesign, and vendor restructuring—yet gain resilience and political durability.

- Who is affected first: Banks, telcos, health/ID systems, AI builders, multinationals.

- Confidence: Medium.

- Watch next: New enforcement actions, “approved cloud” regimes, cross-border transfer restrictions tightening.

Cyber / hybrid spillover

- What happened: Singapore disclosed a cyber-espionage campaign that targeted national telecom infrastructure (with limited disruption but successful infiltration/exfiltration of technical data).

- Where: Singapore; broader Asia telco and critical-infrastructure threat surface.

- Why it matters: Telcos are “upstream dependency” for finance, logistics, emergency services, and cloud—espionage access can become future disruption leverage. )

- Who is affected first: Telcos, government networks, banks/fintechs, critical services relying on carrier networks.

- Confidence: High (official disclosure).

- Watch next: Follow-on advisories, mandated controls, and any lateral movement into government or finance.

Technology standards divergence

- What happened: Cross-border data-transfer frameworks exist (APEC CBPR, ASEAN mechanisms), but legal recognition/adoption remains uneven—creating interoperability friction as localization grows.

- Where: Pan-Asia digital trade + privacy governance.

- Why it matters: Fragmented standards increase transaction costs for regional trade, identity/KYC, payments, and cloud portability.

- Who is affected first: Cross-border platforms, fintechs, exporters using digital channels, regulators.

- Confidence: Medium.

- Watch next: Mutual recognition agreements and “regional compliance rails” that reduce duplication.

Water / food stress

- What happened: The climate signal shifted: forecasters saw La Niña weakening with a higher likelihood of El Niño emerging later, with implications for Southeast Asia rainfall and crop conditions.

- Where: Southeast Asia + broader Asia-Pacific agricultural belts.

- Why it matters: Weather pattern transitions can quickly move rice yields, hydropower output, and food price stability.

- Who is affected first: Farmers, food processors, water utilities, low-income households.

- Confidence: Medium (probabilistic climate signal).

- Watch next: Rainfall anomalies + staple price jumps + reservoir levels.

Social stability pressure

- What happened: Bangladesh’s Feb 12 election environment centered on corruption and inflation pressures—highlighting “cost-of-living + governance trust” as a stability amplifier.

- Where: Bangladesh (and similar inflation-sensitive contexts across South Asia).

- Why it matters: When essentials inflate and trust is low, disruption risk rises around elections, labor markets, and public services.

- Who is affected first: Households, garment/export sectors, local government services, investors.

- Confidence: Medium.

- Watch next: Inflation prints, labor unrest, disruptions to export production.

Drivers & causal chain

Driver A — Tech controls tightening at the tooling layer

- Mechanism: Export controls target enablers (tools/subcomponents/services), slowing capacity expansion and raising compliance friction.

- Second-order effects: Stockpiling, procurement delays, vendor lock-in, higher capex costs.

- Third-order effects: AI/compute rollout slows; downstream device/industrial automation timelines slip.

- Early-warning metric: New rules limiting maintenance/service + allied alignment announcements.

Driver B — Currency/FX pressure + import-cost pass-through

- Mechanism: USD demand and risk-off conditions pressure local currencies; central banks lean on intervention signaling strain.

- Second-order effects: Higher fuel/input costs; tighter margins; reduced discretionary demand.

- Third-order effects: Fiscal stress and political pressure; localized instability.

- Early-warning metric: Parallel/NDF premiums, reserve drawdowns, widening import payment delays.

Driver C — Maritime route volatility and schedule whiplash

- Mechanism: Route uncertainty changes transit times/capacity; markets re-price freight quickly; ports see congestion risk during transitions.

- Second-order effects: Inventory swings; cash tied up in transit; missed delivery windows.

- Third-order effects: Export competitiveness erosion; inflation pockets in import-heavy economies.

- Early-warning metric: Carrier route guidance + insurance risk notices + spot rate jumps.

Driver D — Cloud/data sovereignty becoming “table stakes”

- Mechanism: Localization + sovereign cloud adoption pushes data to stay in-country and reshapes enterprise architecture.

- Second-order effects: Higher compliance and build costs; fewer vendor options; slower cross-border scaling.

- Third-order effects: Regional digital fragmentation and reduced interoperability.

- Early-warning metric: Enforcement actions, new data-transfer constraints, mandated local hosting.

Driver E — Critical infrastructure cyber-espionage targeting “upstream dependencies”

- Mechanism: Telcos and network gear are targeted for long-dwell access and future leverage.

- Second-order effects: Increased security spend; audits; vendor restrictions.

- Third-order effects: Potential outages or systemic trust shocks if access is weaponized.

- Early-warning metric: New telecom advisories; public attribution; mandatory controls.

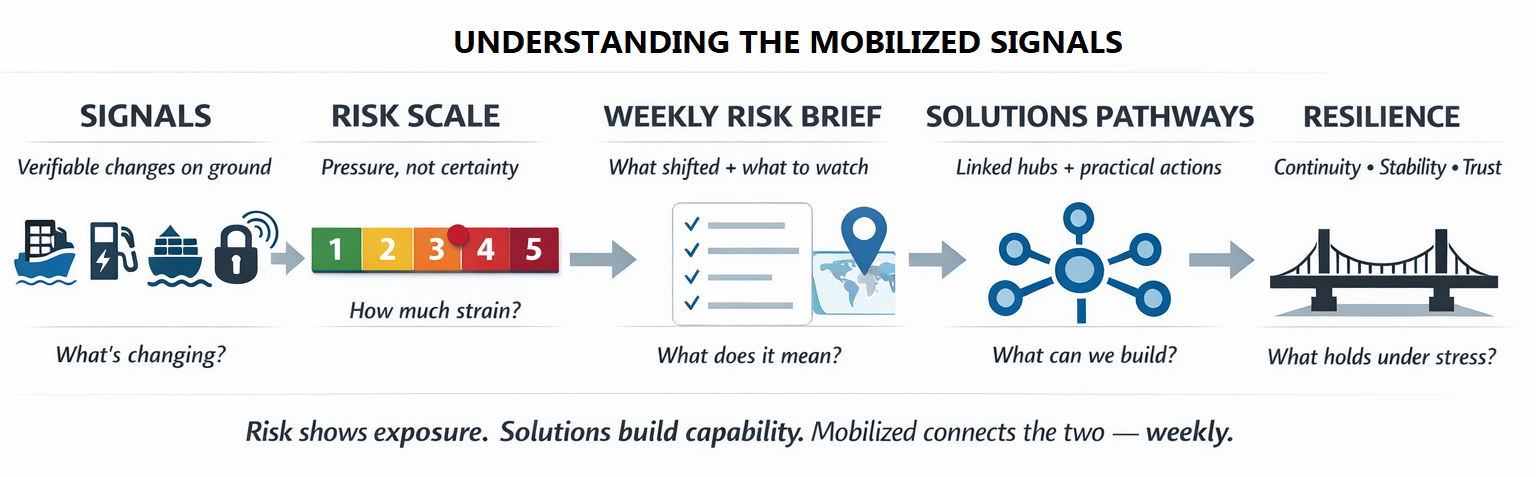

Weekly Risk Index (1–5) — pressure tracking (not prediction)

| Indicator | Score | Dir. vs last week | Rationale | Most important supporting signal |

|---|---|---|---|---|

| Trade controls intensity | 4 | ↑ | Control tightening pressure is rising, especially on tech | US lawmakers push tighter chip-tool controls |

| Financial rail fragmentation | 3 | ↑ | Currency pressure + intervention dynamics persist | INR strain + RBI support |

| Energy stress | 3 | → | Demand recovery, but price sensitivity and weather exposure remain | China LNG import outlook |

| Supply-chain chokepoints | 4 | ↑ | Route volatility keeps lead times/freight unstable | Maersk on Suez return sensitivity |

| Semiconductor constraints | 3 | ↑ | Constraints are policy-driven at tooling/services layer | Controls include tools + maintenance focus |

| Compute & cloud sovereignty pressure | 4 | ↑ | Sovereign cloud adoption and localization are accelerating | Sovereign cloud spend growth |

| Cyber / hybrid spillover | 4 | ↑ | Critical infrastructure targeting confirmed | Singapore telco targeting disclosure |

| Technology standards divergence | 3 | → | Frameworks exist but adoption is uneven | APEC/ASEAN mechanisms uneven |

| Water / food stress | 3 | → | Weather regime transition risk is meaningful but not yet a shock | La Niña weakening / El Niño odds |

| Social stability pressure | 3 | ↑ | Inflation + trust issues elevate disruption risk in sensitive periods | Bangladesh election issues: inflation/corruption |

Top 3 rising pressures: Trade controls; supply-chain chokepoints; cyber spillover.

Top 2 stabilizing pressures: Energy (steady, not spiking); water/food (watchful, signal-based).

Most likely spillover path: Tech controls → semiconductor/tooling friction → electronics lead-time/cost spikes → downstream industrial + consumer inflation pockets.

Regional lens — what it means where you are

United States

- Pricing/supply chains: More tech controls can lift costs for electronics and AI infrastructure inputs; routing volatility affects landed costs for goods.

- Policy: Export control posture is tightening, with higher expectation of allied alignment.

Europe

- Trade alignment: Asia–Europe lanes remain sensitive to Suez/Red Sea route decisions, influencing inventory cycles and inflation.

- Regulation: Interoperability and data-transfer requirements continue to complicate cross-border operations with Asia.

Africa

- Logistics: Asia shipping volatility transmits into African import lead times and costs (machinery, electronics, medicines).

- Currency/essentials: Any Asia-driven price swings in fuel or food inputs can amplify local affordability pressure.

Look ahead — next 7–14 days watchlist

- Any new export-control action on chip tools/services (or allied support). Trigger: new rules/briefings announced.

- Carrier routing changes (return vs avoid Suez/Red Sea). Trigger: major line guidance + insurance warnings.

- Spot freight rate spikes on Asia–EU lanes. Trigger: sudden capacity withdrawals or port congestion.

- India FX stress (NDF/spot gaps, reserves). Trigger: persistent USD demand + larger intervention footprint.

- Telecom sector cyber advisories across Asia. Trigger: new public disclosures or mandated controls.

- Sovereign cloud enforcement steps (data transfer restrictions, “approved cloud” lists). Trigger: enforcement notices or audits.

- LNG pricing and tender cadence (China + NE Asia). Trigger: price jump or unusual tender volume.

- Weather anomaly confirmation in SE Asia (rainfall/heat). Trigger: sustained deviation from normals.

- Food price volatility in import-reliant markets. Trigger: sharp weekly moves in staples.

- Election-related disruptions where inflation/trust are acute. Trigger: strikes, transport disruption, export slowdowns.

Key decision points: export-control agencies; carrier route policies; central bank FX posture; data protection regulators.

Biggest unknowns: route security trajectory; whether controls hit maintenance/services broadly; extent of telco campaign spillover.

Disconfirming signals: stable freight indices; no expansion of chip-tool controls; no further critical-infrastructure disclosures.

From Risk to Solutions — Build the bridge

Bridge 1 — Trade controls → /solutions/adaptive-trade/

- Pressure point: Export-control tightening around advanced chip tooling is rising.

- Why it matters:

- Procurement cycles lengthen and compliance costs rise for Asia manufacturing.

- Downstream device/AI infrastructure availability becomes less predictable.

- Actions

- Business: Dual-source critical tooling/components; build “control-risk” clauses into contracts; map tier-2/3 supplier exposure.

- Community: Support repair/reuse ecosystems for electronics; workforce training for maintenance and refurbishment.

- Policy: Expand trusted-trade lanes; publish clear licensing guidance; coordinate standards to reduce duplicative compliance.

Bridge 2 — Supply chains → /solutions/supply-resilience/

- Pressure point: Asia–Europe logistics remain volatile due to route uncertainty

- Why it matters:

- Inventory and cash get trapped in transit; delivery reliability drops.

- Freight-rate shocks transmit into inflation pockets.

- Actions

- Business: Raise safety stock for critical SKUs; diversify forwarders/ports; renegotiate Incoterms and buffer lead times.

- Community: Localize essentials supply where possible; parts-sharing and repair co-ops to reduce import dependence.

- Policy: Port clearance modernization; transparent dwell-time reporting; priority lanes for medicines and staples.

Bridge 3 — Cyber → /solutions/cyber-resilience/

- Pressure point: Telecom infrastructure targeting confirms high-risk upstream dependency exposure.

- Why it matters:

- Telco compromise can cascade into finance, logistics, and emergency services.

- Espionage access can be repurposed for disruption.

- Actions

- Business: Require carrier security attestations; implement network segmentation and offline failover for core ops.

- Community: Strengthen local continuity plans (communications redundancy for clinics, schools, responders).

- Policy: Minimum security baselines for telcos; rapid disclosure protocols; joint exercises with critical sectors.

Mobilized Weekly Risk Brief — Publish-ready assembly

- Tech controls are tightening at the tooling layer, raising semiconductor and AI infrastructure friction across Asia.

- Shipping volatility remains a top operational risk for Asia exporters/importers tied to Asia–Europe corridors.

- Cyber pressure is “upstream and strategic,” with telecom infrastructure explicitly targeted in a disclosed campaign.

Pressure Map (Top 5)

- Trade controls intensity (4 ↑)

- Supply-chain chokepoints (4 ↑)

- Cyber / hybrid spillover (4 ↑)

- Compute & cloud sovereignty (4 ↑)

- Financial rails fragmentation (3 ↑)

What changed this week

- Export-control rhetoric sharpened around advanced chipmaking tools and support services.

- Carrier routing uncertainty continued to keep Asia–Europe logistics planning fragile.

- A high-credibility telecom targeting disclosure reinforced critical-infrastructure cyber risk.

Why it matters (Business + Communities)

- Business: Expect longer procurement timelines, higher compliance overhead, and inventory/cashflow volatility.

- Communities: Cost pressures and service reliability are increasingly coupled to invisible dependencies (telcos, ports, cloud).

Regional Snapshot (USA / Europe / Africa)

- USA: Export controls drive global supply chain behavior and pricing expectations.

- Europe: Freight and scheduling volatility affects inventory, inflation, and industrial inputs.

- Africa: Asia-linked logistics and price swings transmit into import costs and lead times for essentials and capital goods.

Look ahead (7–14 days)

Watch: export-control actions, carrier routing, India FX stress signals, telco cyber advisories, and SE Asia weather anomalies.

Mobilized Action

- Run a “controls exposure map” on top 50 parts/tools/services linked to advanced chips and networking.

- Add logistics volatility buffers (inventory + time) for Asia–Europe lanes and key components.

- Harden telecom dependency plans (segmentation, offline fallback, carrier assurance).

- Prepare for localization (data classification + residency-ready architecture) before enforcement hits.

- Stress test FX and import-cost sensitivity for fuel, chemicals, electronics, and food inputs.

Accuracy & Trust Layer

- Overall confidence: Medium–High (strong on trade controls, shipping, cyber; medium on water/food because it’s a probabilistic climate transition signal).

- Top 3 uncertainties

- Whether chip-tool restrictions expand to services/maintenance broadly and how allies align.

- Red Sea/Suez security and the timing/shape of routing normalization.How far telco intrusion activity spreads across the region’s critical infrastructure supply chain.

- What would change our assessment (disconfirming signals)

- Stable freight indices for two consecutive weeks; no further expansion of chip-tool measures; no additional critical-infrastructure disclosures.

- Source types to verify (categories)

- Export-control agencies and customs; major carriers/insurers; port authorities; central banks/FX market bulletins; national CERTs/telecom regulators; cloud/data protection regulators.