What Changed The Week of February 7-13, 2026

What Changed The Week of February 7-13, 2026

What changed this week

Trade controls intensity

- What happened: Strategic-minerals and defense-linked supply chains kept tightening globally, with African exporters seeking higher-compliance routes into regulated markets.

- Where: East/Central Africa export corridors; US/EU compliance-heavy buyers (spillover into Africa logistics).

- Why it matters: More documentation, longer lead-times, and “who-you-sell-to” constraints can slow cashflow for miners, traders, and ports.

- Affected first: Exporters, customs brokers, ports, manufacturers relying on inputs.

- Confidence: Medium (clear direction; uneven country-by-country).

- Watch next: Any new buyer screening rules, export licensing changes, or border delays on key corridors.

Financial rail fragmentation

- What happened: Central banks moved to protect FX liquidity and access: Nigeria expanded official FX supply channels to retail FX traders (BDCs) with tighter compliance rules.

- Where: Nigeria (FX market plumbing); broader SSA watching liquidity conditions.

- Why it matters: When FX access tightens, imports (fuel, food, parts) get pricier and slower—raising operational risk for businesses.

- Affected first: Importers, fuel marketers, food supply chains, SMEs.

- Confidence: High.

- Watch next: Parallel-market spread vs official rate; new compliance actions; import backlogs.

Energy stress

- What happened: South Africa advanced structural electricity reform (moving ahead with Eskom break-up and independent transmission), while regulators approved higher future tariff increases than previously set—signaling both reform momentum and rising cost pressure.

- Where: South Africa (grid + tariffs) with knock-on impacts to regional suppliers.

- Why it matters: Reliability improvements reduce downtime risk, but tariff increases raise operating costs and household strain.

- Affected first: Industry, municipalities, households, energy-intensive SMEs.

- Confidence: High.

- Watch next: Implementation timeline; procurement pace for transmission upgrades; tariff pass-through effects.

Supply-chain chokepoints

- What happened: Red Sea/Suez uncertainty continued to distort routing, capacity, and freight pricing—raising volatility for East/Southern Africa import/export lead times.

- Where: Suez-linked corridors affecting East Africa and Southern Africa trade lanes.

- Why it matters: Even a hint of route normalization or renewed disruption can whip freight rates, insurance costs, and inventory planning.

- Affected first: Retailers, construction materials, pharma, food importers, exporters with time-sensitive cargo.

- Confidence: Medium (market is reactive).

- Watch next: Carrier route decisions; insurance advisories; port dwell times.

Semiconductor constraints

- What happened: No single “chip shock” signal in Africa this week; the pressure remains indirect—electronics lead-times remain sensitive to global trade policy and routing risk.

- Where: ICT imports across Africa (network gear, devices).

- Why it matters: Telecom rollouts, payment terminals, and public-service digitization depend on steady electronics supply.

- Affected first: Telcos, banks/fintechs, device retailers, public digital service programs.

- Confidence: Low–Medium (weak week-specific signal; structural risk persists).

- Watch next: Any export-control expansions, freight spikes, or large telco procurement delays.

Compute & cloud sovereignty pressure

- What happened: “Sovereign cloud / local data” pressure kept rising as more African policy and market narratives push data residency + local infrastructure as prerequisites for AI and digital services.

- Where: Multiple African jurisdictions (policy direction); enterprise compliance planning.

- Why it matters: Firms may need regionalized architectures, new vendors, and in-country hosting—raising cost/complexity but improving resilience and trust.

- Affected first: Banks, telcos, health systems, platforms processing citizen data.

- Confidence: Medium.

- Watch next: New data localization rules; audits; “approved cloud” frameworks.

Cyber / hybrid spillover

- What happened: Nigeria signaled stepped-up cyber defenses as attacks (including AI-enabled threats) pressure banks, payments, and government systems

- Where: Nigeria (high signal), with regional spillover via shared vendors and cross-border payments.

- Why it matters: Payment downtime and identity fraud hit trust fast—especially where digital rails are expanding.

- Affected first: Banks/fintechs, telecoms, government e-services, SMEs reliant on digital payments.

- Confidence: Medium (high plausibility; details often under-disclosed).

- Watch next: Sector-wide advisories; major outages; new mandatory controls.

Technology standards divergence

- What happened: Digital identity + DPI “rails” accelerated as a practical standard layer (e-KYC, interoperability), but fragmentation risk rises when country implementations diverge.

- Where: Pan-African DPI efforts + national implementations.

- Why it matters: Interop gaps raise cross-border friction (trade, payments, mobility) and increase vendor lock-in risk.

- Affected first: Regional traders, fintechs, cross-border service providers, governments.

- Confidence: Medium.

- Watch next: Mutual recognition agreements; shared specs; procurement choices.

Water / food stress

- What happened: Horn of Africa drought impacts deepened—millions face hunger and severe water scarcity in Kenya and surrounding areas; displacement risk rises.

- Where: Kenya (NE counties), spillover across the region.

- Why it matters: Food price spikes, livestock losses, and migration pressures quickly become economic + stability risks.

- Affected first: Households, pastoralists, local markets, local government services.

- Confidence: High.

- Watch next: Rainfall outcomes; malnutrition admissions; water trucking and borehole failures.

Social stability pressure

- What happened: Immediate “acute shock” signals clustered around climate stress and affordability pressures (energy tariffs; food/water scarcity). This is a classic pathway to localized unrest even without a headline protest week.

- Where: Horn of Africa drought zones; cost-pressure urban centers.

- Why it matters: Stability risk grows when essential goods (water, fuel, food, power) become unreliable or unaffordable.

- Affected first: Households, informal workers, local governments, critical-service providers.

- Confidence: Medium.

- Watch next: Bread/fuel price jumps, service interruptions, local strike activity.

Drivers & causal chain — what’s actually moving the system

Driver A — FX liquidity + cost of imports

- Mechanism: When USD liquidity tightens, importers pay more (or wait longer), pushing inflation and shortages; central banks intervene (e.g., Nigeria expanding official FX supply channels).

- Second-order: Higher transport + food costs; delayed spare parts; business working-capital stress.

- Third-order: Service reliability drops (power, health supply chains), raising social pressure.

- Early-warning metric: Parallel-market FX premium; import clearance backlogs; fuel station shortages.

Driver B — Climate extremes hitting food/water + logistics at once

- Mechanism: Drought reduces yields and livestock health; storms/flooding damage roads, housing, and port/rail access (e.g., cyclone impacts near Madagascar/Mozambique)

- Second-order: Price spikes, displacement, disease risk, school/work disruption.

- Third-order: Cross-border migration tension; higher security and humanitarian burdens.

- Early-warning metric: Rainfall anomalies; malnutrition admissions; commodity price surges.

Driver C — Power-sector restructuring + price pass-through

- Mechanism: Grid reform improves long-term reliability but near-term costs rise (tariff adjustments; major restructuring steps).

- Second-order: Higher costs for SMEs; affordability strain for households; political pressure on regulators.

- Third-order: Investment decisions shift; manufacturing competitiveness changes.

- Early-warning metric: Tariff pass-through to CPI; outage frequency; municipal arrears.

Driver D — Shipping-route volatility (Red Sea/Suez)

- Mechanism: Route risk changes transit times, capacity, and insurance; markets re-price quickly.

- Second-order: Inventory swings; stockouts; working-capital strain.

- Third-order: Inflation pockets; reduced export competitiveness.

- Early-warning metric: Spot freight indices; carrier routing announcements; port dwell times.

Driver E — Data sovereignty + cyber risk rising together

- Mechanism: Governments tighten data rules and push localized compute while attackers target expanding digital payment/ID surfaces.

- Second-order: Compliance costs; vendor consolidation; outage/fraud risk.

- Third-order: Trust erosion; slower digitization; geopolitical tech fragmentation.

- Early-warning metric: New localization mandates; breach/outage reporting; sector audits.

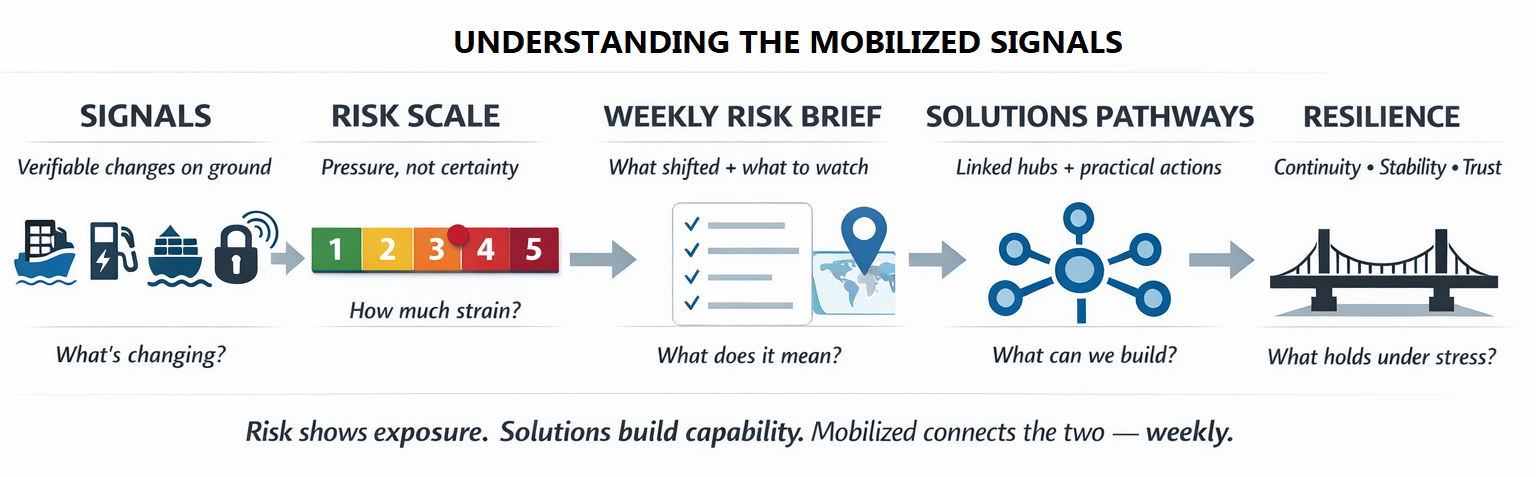

3️⃣ Weekly Risk Index — pressure tracking (1–5)

| Risk Index indicator | Score | Dir. vs last week | Rationale | Single most important signal |

|---|---|---|---|---|

| Trade controls intensity | 3 | → | Compliance-heavy supply chains tightening, but no broad new Africa-wide controls | Regulated-market supply chain tightening signal |

| Financial rail fragmentation | 4 | ↑ | FX access remains a live constraint; policy interventions indicate stress | Nigeria FX liquidity move |

| Energy stress | 3 | → | Reform momentum helps reliability outlook; tariffs increase affordability pressure | SA tariff recalculation |

| Supply-chain chokepoints | 4 | ↑ | Red Sea/Suez volatility keeps routing and pricing unstable | Suez/Red Sea market fragility |

| Semiconductor constraints | 2 | → | No fresh shock; risk is indirect through electronics supply and trade policy | Electronics supply-chain risk persists |

| Compute & cloud sovereignty pressure | 3 | ↑ | Data residency + sovereign cloud push increasing compliance load | Sovereign cloud + data rules |

| Cyber / hybrid spillover | 3 | ↑ | Rising defenses reflect rising threat pressure on banks/payments | Nigeria cyber defense move |

| Technology standards divergence | 3 | → | DPI and digital ID rails advancing, but interop divergence risk remains | DPI operationalization |

| Water / food stress | 5 | ↑ | Drought-driven hunger and water scarcity intensifying | Kenya/Horn drought impacts |

| Social stability pressure | 4 | ↑ | Essentials pressure (food/water/energy affordability) is the main accelerant | Drought + tariff affordability strain |

Top 3 rising pressures: Water/food stress; supply-chain chokepoints; FX/financial rails.

Top 2 stabilizing pressures: Semiconductors (no new shock); energy reliability directionally supported by reforms (cost still rising).

Most likely spillover path: Drought → food prices/displacement → urban affordability strain → localized stability incidents.

Regional lens — what it means where you are

United States

- Pricing: Any freight volatility via Suez/route shifts can ripple into consumer goods prices and lead times.

- Supply chains: Critical minerals compliance and traceability requirements keep tightening.

Europe

- Trade alignment: Continued sensitivity to Red Sea/Suez routing and insurance conditions.

- Financial rails: Euro liquidity access lines and cross-border funding conditions matter for African counterparties and banks with Europe exposure.

Africa

- Food/water stress: Drought is the headline risk driver for households and stability.

- Energy access + affordability: Reform + tariff increases can improve reliability but raise cost pressure.

- Currency pressure/logistics: FX interventions signal ongoing import cost and availability risk; route volatility adds lead-time uncertainty.

Look ahead — next 7–14 days watchlist

- Rainfall outcomes in Horn of Africa — confirms easing/acceleration of food stress. Trigger: continued below-normal rainfall + rising malnutrition admissions.

- Cyclone/flood impacts in Southern Africa corridors — roads/ports disruption. Trigger: renewed landfall or major infrastructure damage.

- Nigeria FX spread — indicates rail stress. Trigger: widening parallel premium or new access restrictions.

- Red Sea/Suez route decisions — swings freight costs quickly. Trigger: major carrier reroutes or insurance advisories

- South Africa electricity tariff reaction — affordability + stability signal. Trigger: municipal payment stress, protests, or emergency relief measures.

- Grid reform implementation milestones (SA) — reliability pathway. Trigger: published timelines, procurement or legal challenges.

- Banking/payment cyber advisories (West Africa) — systemic exposure. Trigger: sector-wide alerts or payment outages.

- Data localization / “sovereign cloud” policy moves — compliance cost shifts. Trigger: new mandates or enforcement actions.

- Staple food price spikes in drought-affected markets — stability accelerant. Trigger: rapid week-on-week price jumps.

- Humanitarian funding gaps — capacity to buffer shocks. Trigger: announced cuts/delays in response funding.

Key decision points: Central bank FX rules (Nigeria); tariff and grid reform steps (South Africa); national data protection/localization enforcement.

Biggest unknowns: Rainfall trajectory; Red Sea security/routing; scale of cyber incidents (often underreported)

Disconfirming signals: Narrowing FX premium; improving rainfall and nutrition stats; sustained freight rate normalization.

From Risk to Solutions — build the bridge

Bridge 1 — Water/Food stress → /solutions/water-food/

- Pressure point: Drought-driven hunger and water scarcity are escalating in the Horn of Africa.

- Why it matters:

- Household survival risk rises fast (malnutrition, displacement).

- Food price spikes destabilize local economies and governance capacity.

- Actions

- Business: Secure dual sourcing for staples; pre-position inventory; support water logistics for workforce continuity.

- Community: Water-point maintenance teams; local early-warning messaging; school meal protection where possible.

- Policy: Fast-track drought response financing; protect cross-border food corridors; expand cash-transfer coverage.

Bridge 2 — Supply-chain chokepoints → /solutions/supply-resilience/

- Pressure point: Route volatility around Red Sea/Suez keeps lead times and freight costs unstable.

- Why it matters:

- Import-dependent sectors face stockouts and cost spikes.

- Working capital gets trapped in transit.

- Actions

- Business: Increase safety stock for critical SKUs; diversify shipping lanes and forwarders; renegotiate Incoterms/risk-sharing.

- Community: Local procurement where feasible; repair/maintenance cooperatives to extend asset life.

- Policy: Port clearance modernization; priority lanes for medicines and staples; transparent dwell-time reporting.

Bridge 3 — Financial rails (FX liquidity) → /solutions/resilient-payments/

- Pressure point: FX access and compliance tightening continue to create import friction and pricing volatility.

- Why it matters:

- Businesses can’t plan input costs; SMEs get squeezed first.

- Households absorb inflation through essentials.

- Actions

- Business: Hedge where possible; invoice in mixed currencies; shorten receivables cycles; build local supplier substitution plans.

- Community: Bulk-buying co-ops for essentials; community stabilization funds for key services.

- Policy: Improve FX transparency; widen legal channels; enforce anti-fraud controls without choking legitimate supply.

Publish-ready assembly — Mobilized Weekly Risk Brief

- Food & water stress is the dominant risk driver this week, with drought conditions pushing hunger and displacement pressures.

- Logistics remain fragile due to Red Sea/Suez volatility, keeping freight pricing and lead times unstable.

- FX and digital trust risks are rising together: FX interventions show import pressure; cyber/data sovereignty pressures raise operational complexity.

Pressure Map

- Water/Food stress (5 ↑)

- Supply-chain chokepoints (4 ↑)

- Social stability pressure (4 ↑)

- Compute/cloud sovereignty + cyber (3 ↑)

What changed this week

- Drought impacts intensified in parts of East Africa, reinforcing food/water stress as the main near-term risk.

- Southern Africa’s energy story is “reform plus price pressure”: structural steps forward, but higher approved tariff increases ahead.

- FX liquidity management stayed active (Nigeria), while global shipping uncertainty continued to drive logistics volatility.

Why it matters (Business + Communities)

- Business: The combo of import friction (FX + freight) and climate shocks (drought/storms) hits margins, uptime, and customer demand simultaneously.

- Communities: Essentials stress (water, food, power affordability) is the fastest route from “hard week” to “unstable month.”

Regional snapshot (USA / Europe / Africa)

- USA: Sensitive to freight volatility and regulated mineral supply chains.

- Europe: Trade/logistics sensitivity via Suez; euro liquidity dynamics matter for African counterparts

- Africa: Drought-driven food/water stress + FX friction + logistics volatility are the core near-term pressures.

Look ahead (7–14 days)

Watch: rainfall outcomes; cyclone/flood disruptions; FX spreads; carrier routing; tariff pass-through; payment/cyber advisories.

From risk to solutions

- Water/Food → /solutions/water-food/ (drought response + resilience)

- Supply chains → /solutions/supply-resilience/ (inventory + corridor reliability)

- Financial rails → /solutions/resilient-payments/ (FX transparency + anti-fraud + continuity)

Mobilized Action (5 max)

- Stand up a local “Essentials Watch” (water points, staple prices, clinic stockouts) in drought/storm zones.

- Pre-position critical inventory (meds, spare parts, staples) for 30–60 days where cashflow allows.

- Run an FX + freight stress test on your top 20 imported inputs (what breaks first?).

- Harden payment operations (offline fallback, fraud controls, vendor access reviews).

- Plan for affordability shocks (tariff/food): targeted support for frontline workers and essential services.

Accuracy & Trust Layer (always include)

- Overall confidence (this brief): Medium (strong on drought/energy/FX; weaker on semiconductors and week-specific trade-control signals).

- Top 3 uncertainties

- Near-term rainfall trajectory and how quickly malnutrition/displacement accelerates.

- Red Sea/Suez routing decisions and insurance/rate sensitivity.

- True cyber incident rate (underreporting + delayed disclosure).

- What would change our assessment (disconfirming signals)

- Rainfall improves and nutrition admissions stabilize; FX premium narrows; freight rates normalize and stay stable.

- Source types to verify (categories)

- Central banks & FX market bulletins; port/terminal operators; grid operators/regulators; humanitarian early-warning systems; major carriers/insurers; national CERTs/banking regulators.